Interest Expense 2024 On Schedule A

If you are searching about Solved X2 issued callable bonds on January 1, 2021. The | Chegg.com you’ve came to the right web. We have 15 Pics about Solved X2 issued callable bonds on January 1, 2021. The | Chegg.com like Solved X2 issued callable bonds on January 1, 2021. The | Chegg.com, Fillable Schedule I (Form 1120-F) – Interest Expense Allocation Under and also Interest Expense Formula | Calculator (Excel template). Read more:

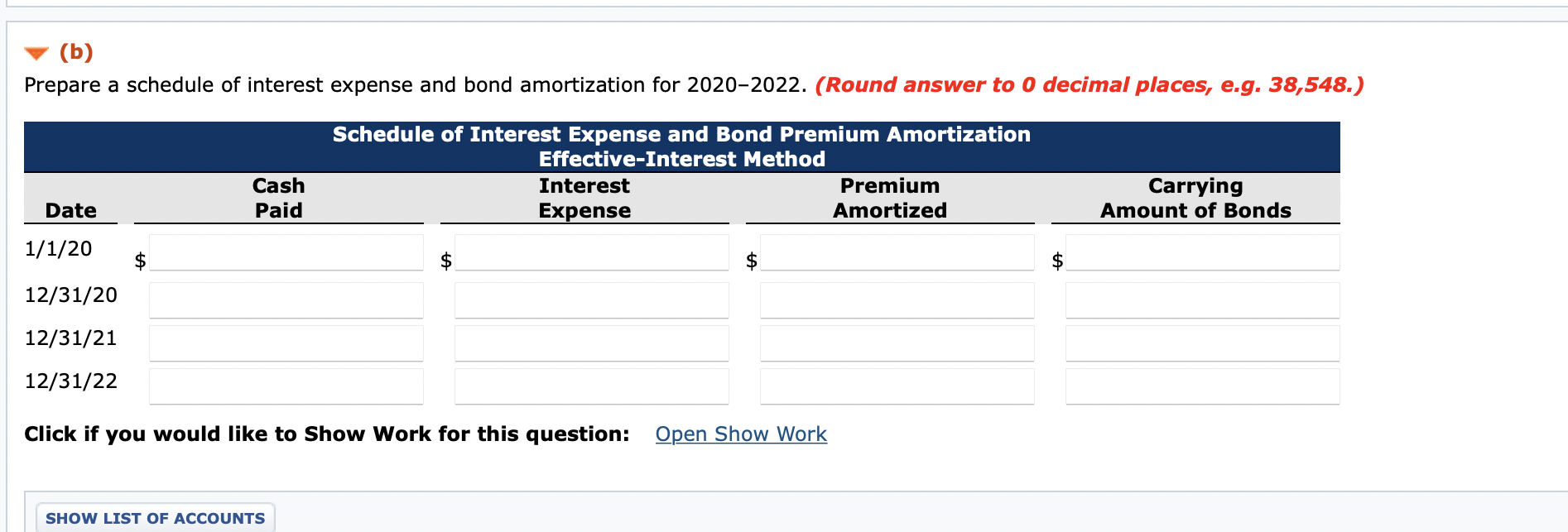

Solved X2 Issued Callable Bonds On January 1, 2021. The | Chegg.com

Photo Credit by: www.chegg.com bonds x2 issued callable pay 2021 january interest solved annually december year transcribed problem text been show accountant each

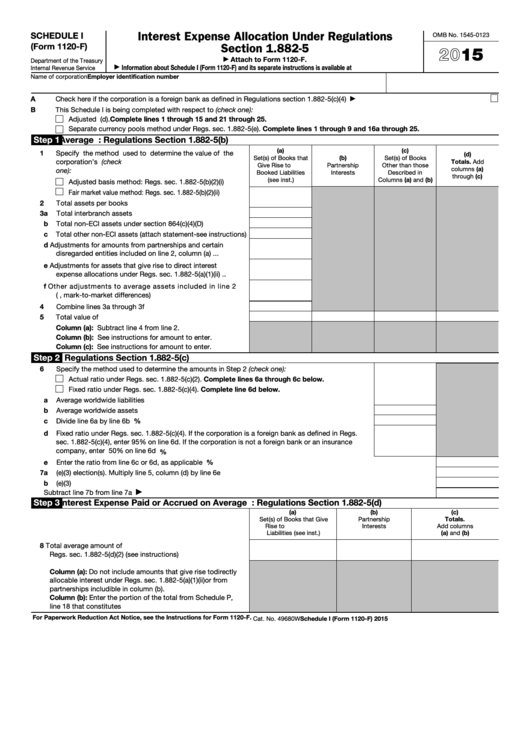

Fillable Schedule I (Form 1120-F) – Interest Expense Allocation Under

Photo Credit by: www.formsbank.com interest schedule form 1120 expense treasury department allocation regulations under section fillable pdf printable

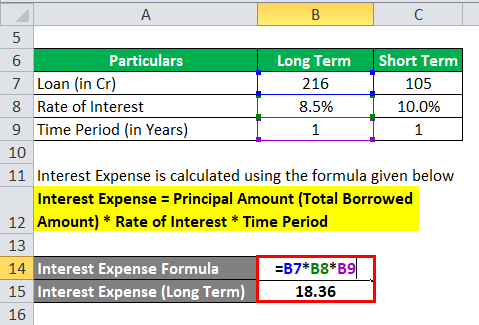

Interest Expense Formula | Calculator (Excel Template)

Photo Credit by: www.educba.com expense inr excel

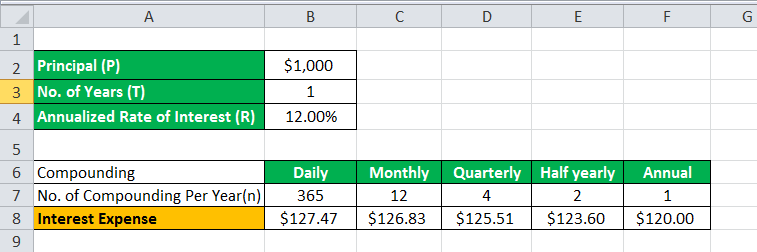

Interest Expense Formula | Top 2 Calculation Methods

Photo Credit by: www.wallstreetmojo.com expense calculation compounding periods

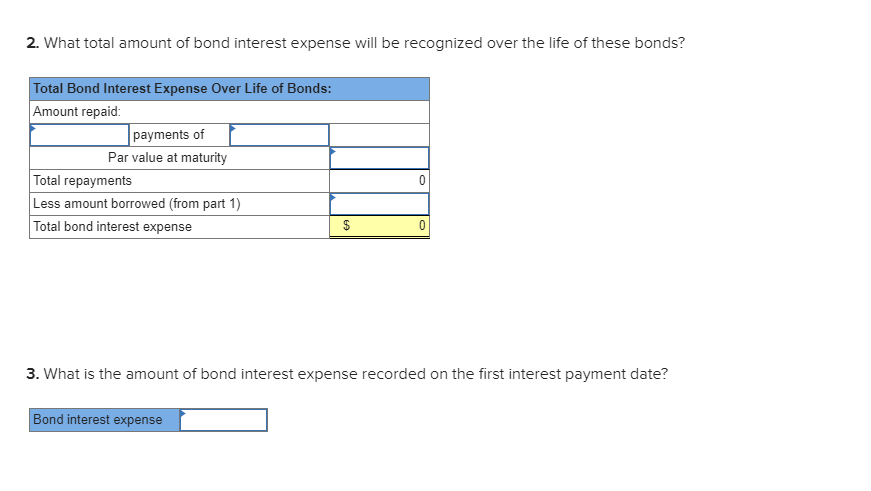

How To Figure Out Total Bond Interest Expense ⋆ Accounting Services

Photo Credit by: accounting-services.net expense

Business Interest Expense Deduction Limitation | Bayshore CPA's, P.A.

Photo Credit by: bayshorecpas.com expense limitation deduction occurred debt showcasing

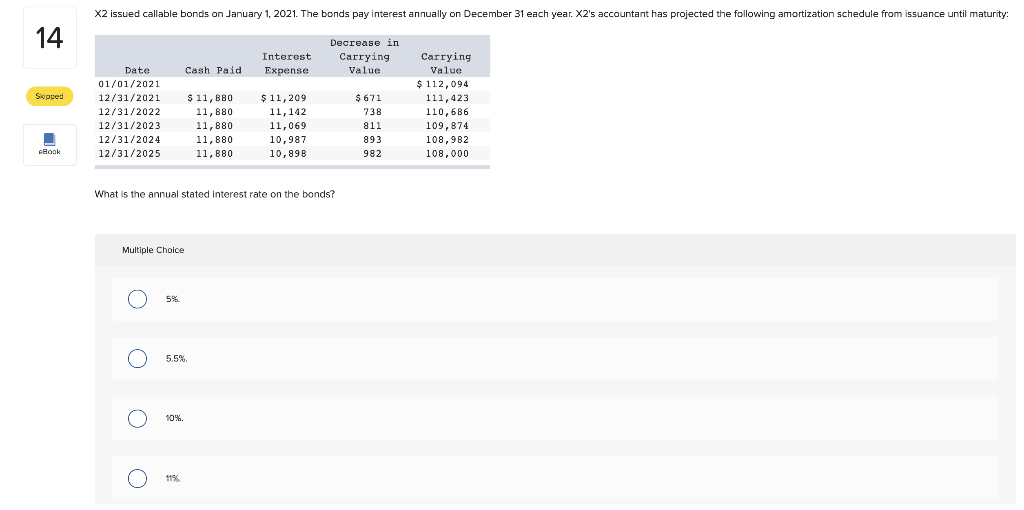

Solved (b) Prepare A Schedule Of Interest Expense And Bond | Chegg.com

Photo Credit by: www.chegg.com

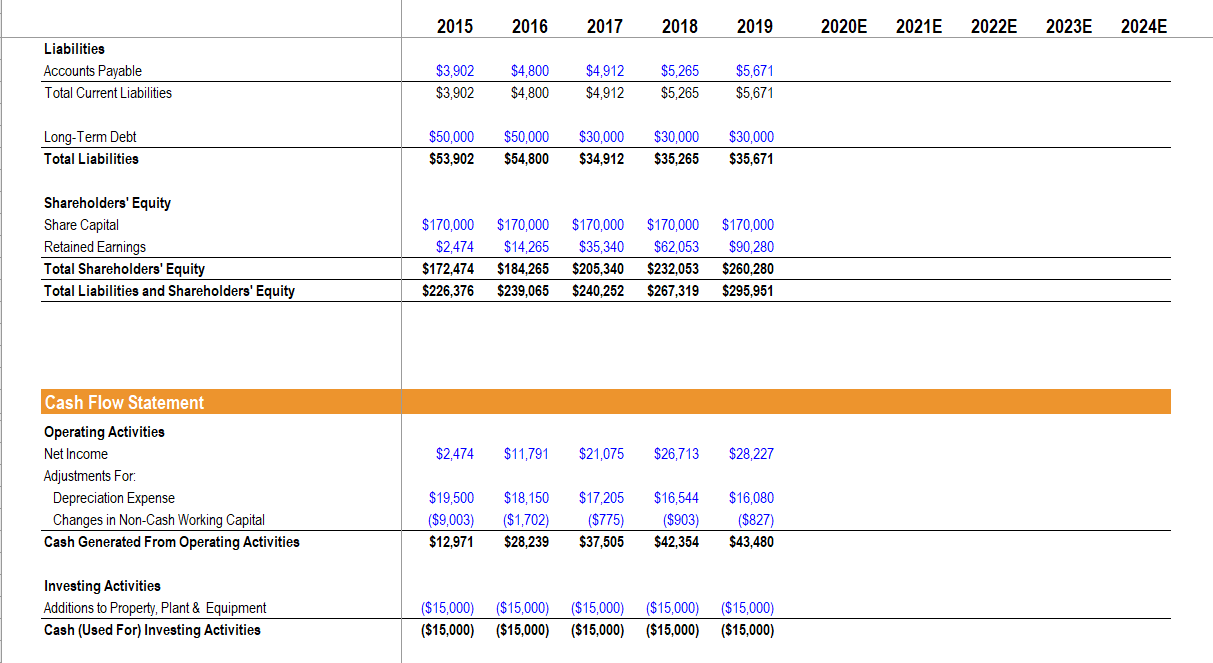

Solved 1. Using The High Case, Calculate Interest Expense In | Chegg.com

Photo Credit by: www.chegg.com

Interest Expense – Video | Investopedia

Photo Credit by: www.investopedia.com expense investopedia

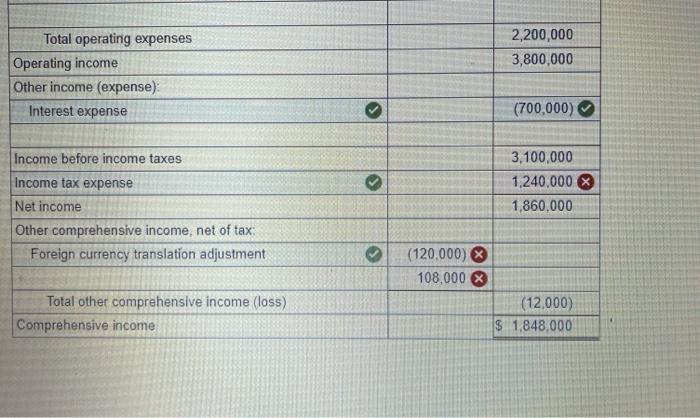

Solved Duke Company's Records Show The Following Account | Chegg.com

Photo Credit by: www.chegg.com show company following duke records account expense income been solved transcribed text

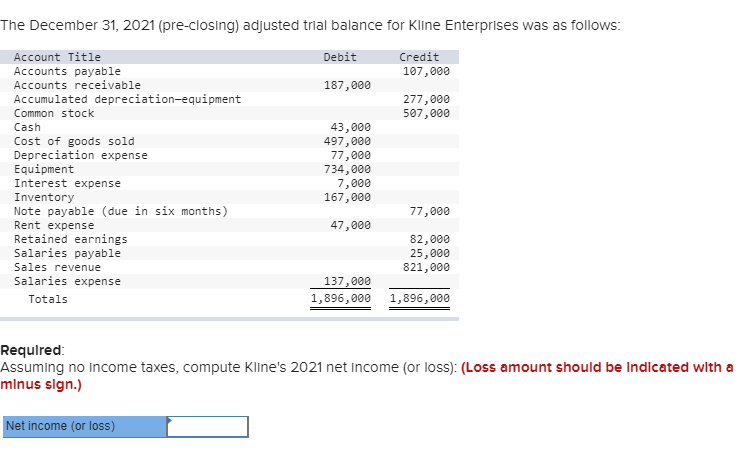

Solved The December 31, 2021 (pre-closing) Adjusted Trial | Chegg.com

Photo Credit by: www.chegg.com adjusted trial kline follows closing debit accounts solved

Solved The Following Amortization Schedule Indicates The | Chegg.com

Photo Credit by: www.chegg.com note interest principal amortization schedule installment year payable indicates following notes payment december repaid solved january annual expense march total

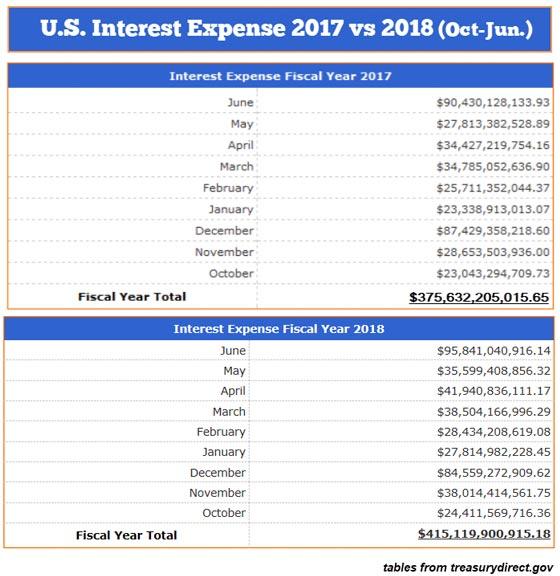

The U.S. Government To Fork Out A Half Trillion To Service Its Debt In

Photo Credit by: seekingalpha.com debt service expense interest fork trillion government half its year

E9-11 On January 1, 2021, White Water Issues $600,000 Of 7% Bonds, Due

Photo Credit by: www.homeworklib.com homeworklib bonds

Teal Company Sells 8% Bonds Having A Maturity Value Of $3,000,000 For

Photo Credit by: www.homeworklib.com bonds maturity sells homeworklib attached

Interest Expense 2024 On Schedule A: The u.s. government to fork out a half trillion to service its debt in. Solved the following amortization schedule indicates the. Expense calculation compounding periods. Solved (b) prepare a schedule of interest expense and bond. Solved the december 31, 2021 (pre-closing) adjusted trial. Expense limitation deduction occurred debt showcasing